Calgary Housing 2026: Boom, Bust, Retreat?

While trying to predict the future is futile, nearly everyone does it, especially at the beginning of the year. Predicting the future of Calgary’s housing market preoccupies many Calgarians given it is either their biggest investment (mortgage) or their biggest expense (rent).

Will the “Broadway on 17th” project start construction at the corner of 17th Ave and 4th St SW in 2026?

In reality, three things can happen in 2026:

The housing boom can continue, with a new record number of housing starts.

Housing starts can retreat to a sustainable and healthy 17,000 to 20,000 per year.

Housing starts could drop below 17,000 because of over-building the past several years, an economic downturn and/or reduced immigration.

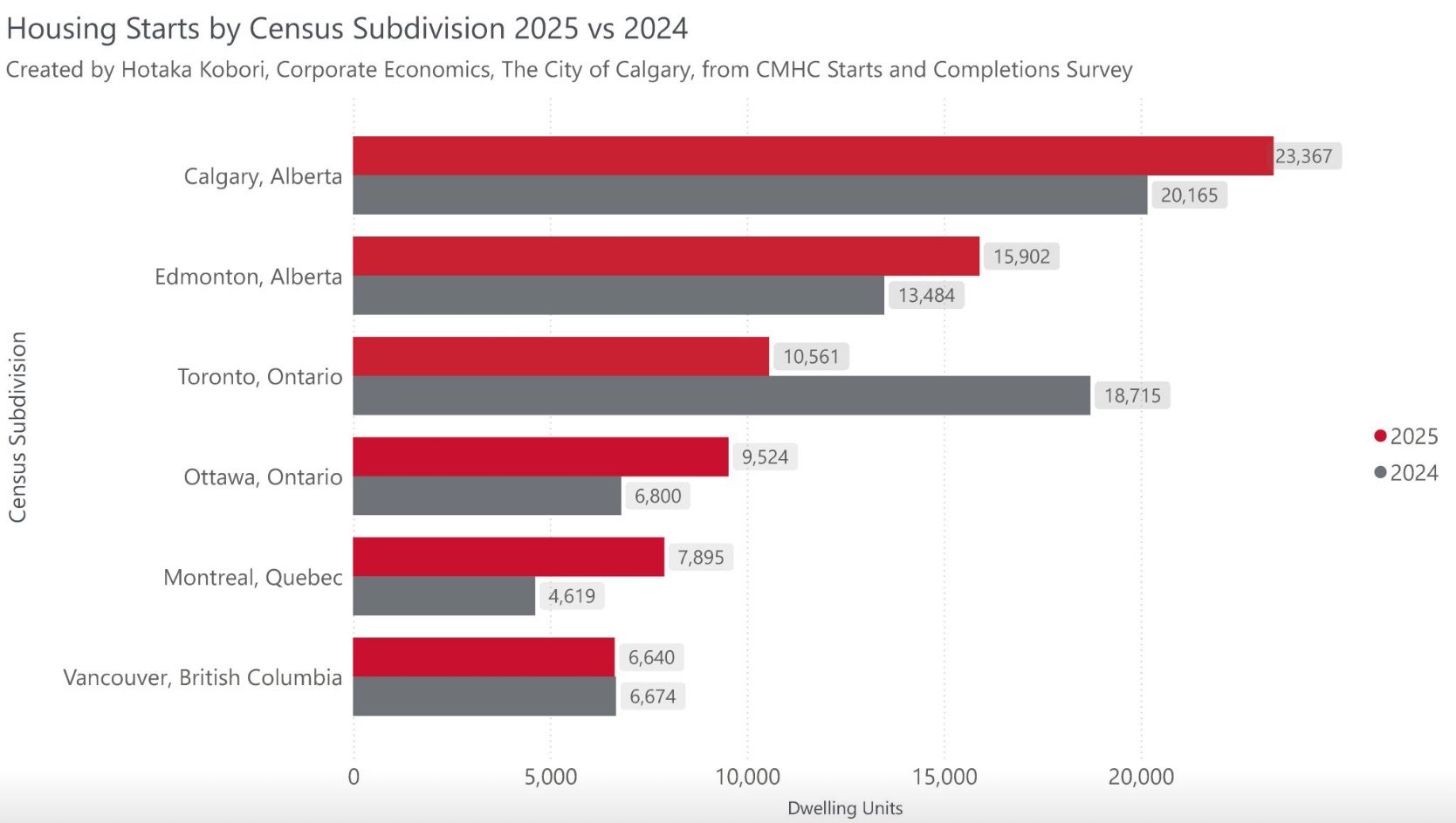

Will Calgary continue to lead Canada in housing starts again in 2026?

Questions?

To predict the future of Calgary’s housing market you must consider the following:

Will Calgary’s population continue to grow at above average rates due to people moving here from other provinces and countries?

Will Calgary home builders continue to build new homes at record rates?

Have developers over built for the 2026 demand?

Will the City of Calgary repeal “blanket rezoning” or just modify it?

How will the federal government various housing incentive programs impact new home construction in Calgary in 2026, especially if “blanket rezoning” is repealed?

How will the domination of purpose-built rental impact the multi-family market? (70% of new multi-family building starts were rentals in 2025, while only 30% were condos)?

How will USA tariffs impact Calgary’s economy in 2026?

Will interest rates remain low?

Will infill row housing continue at a similar pace in 2026 as it did in 2025?

What are the experts saying?

Ann-Marie Lurie, Chief Economist at Calgary Real Estate Board, sees a softening of the housing market in 2026 as immigration continues to decline and the uncertainty around Calgary’s employment growth in 2026 and beyond.

Record housing starts for the past three years have created a large supply of new homes, purpose-built rentals and condos, which means buyers and renters have lots of choices. Overall, prices in the NE have already dropped by 13%, which is an indicator of a softer housing market across the city.

However, prices for detached and semi-detached homes remain strong across the city, especially in the inner-city where redevelopment opportunities have increased the land values thanks to blanket rezoning.

Calgary Mortgage and Housing Corporation’s latest projections has the total number of housing starts in 2026 ranging from a low of 17,500 to a high of 27,500 - that’s a huge variance. Single-detached housing starts are estimated at a low of 5,000 to a high of 8,500 with multi-family (duplexes, townhomes, apartment buildings) having a low of 12,500 homes to a high of 19,000 homes. CHMC’s low numbers would still represent a healthy number of housing starts in 2026, while the high numbers would represent a small growth in housing starts from 2025.

CMHC is predicting Calgary home prices in 2026 will remain similar to 2025, with slower growth in average rents due to the increase in supply of purpose-built rentals.

The ATB Economics and Real Estate Team “anticipates a cooling period for housing starts in 2026, as the market begins to absorb the increased inventory from the preceding years and as population growth slows. This adjustment reflects a natural progression as supply catches up with demand, leading to a more moderate pace of construction activity. We expect starts to level off at over 20,000 in Calgary next year.

A possible emerging trend could be a shift from multi-family apartment rental housing into townhouse ownership. Many newcomers rent first, and a significant number of new people have come to Calgary the past few years. The removal of GST will likely support more purchaser activity; while this segment was soft in 2025, conditions may shift in 2026.”

The ATB team also notes: “Calgary metro area (CMA) is on pace to post its fourth consecutive record year for housing starts in 2025. So far in 2025 (data through October), there have been 6 months where housing starts in Calgary CMA exceeded that of the Toronto CMA. Prior to 2025, that only happened 8 other times (including 4 months in 2024). For context, the population of Toronto CMA is 7.1 million vs. Calgary’s 1.8 million (as of 2024).

ATB anticipates flat to modest growth (0%-3%) in benchmark housing prices for 2026.

Will we continue to see mega infill projects thrive like West District, Currie, University District in 2026.

Canary in the mine

When it comes to the future of multi-family housing (condos and rentals), architectural firms are arguably probably the best indicator of what the future holds. Why? Because they are not only the ones who are engaged first when a developer in the early stages of planning a new multi-storey building, buy also the first to be asked to stop work on a project if a developer is considering cancelling or delaying a project. (Note: Architectural firms are not as involved in the single, duplex and townhome designs.)

So, if architectural firms are busy with new projects, that’s a positive sign. But if they are seeing fewer new projects or if existing projects are getting put on hold that is an indicator things are slowing down.

Calgary’s NORR office designs more multi-family housing in Calgary than any other firm. So, what do they think the future holds?

Don Dessario, Senior Principal at NORR indicated “NORR’s design studio is projected to be very busy for 2026 and the foreseeable future. They currently have 239 active projects and 38 inactive ones at various stages from concept to final drawings. This is on par with the level of activity at the end of the 2024 and throughout 2025. It appears at this time 2026 will be on par with 2025. As far as the multi-family buildings, it is about a 50/50 split between purpose-built rentals and homeowner condos projects.”

Last Word

Predicting future housing demand - not just for one year, but five and ten years into the future - is critical to new home builders. That’s due to the fact it takes 3 to 10+ years to go from site purchase, to finance, to approval, to marketing and sales, to construction and finally occupancy depending on size and complexity of the project. So, they need to forecast what the market is going in the future.

And it is even more critical for large condo building developers as the $100+ million decision to start construction on a 200-home building that will take 2 to 3 years to complete is very different than a developer who is building 50+ homes per year.