New Home Levies & Fees Gone Wild

I have often wondered why new home builders don’t advertise new home and condo prices like the gas pumps, i.e. identifying what percent of the home’s cost is land, permit fees and levies. It doesn’t seem fair that home builders should be the ones who are most often blamed for the high cost of housing when in fact most of the increase is due to increases in land, levies and permit fees (there is also the increased cost of materials, wages and overhead); it is not simply the desired profit for the home builder.

Levies and Fees?

Levies are fees developers pay per acre to the City of Calgary upfront, as a condition of development. These levies in new communities fund the new development’s share of interchanges, water and wastewater systems (e.g. treatment plants, stormwater management) and community infrastructure (e.g. transit buses, fire halls, libraries, police stations and recreation facilities).

The City Centre Levy is based on linear frontage of the site; strangely the costs are per foot of east to west street frontage but doesn’t include the north to south frontage. Similarly, the money collected is used to fund utility upgrades, as well as transit, fire, police, recreation, library and park upgrades.

There are additional hoarding fees, (fencing around the site), compensation for lost parking revenue and street closure fees for major City Centre projects. I was shocked when a developer shared with me that they had to pay $350,000+ for hoarding fees, $80,000+ parking fees and $50,000 for street closure fees for a City Centre projects with just over 100 homes (i.e. about $5,000 per home).

Increase in Levies

From 2011 to the current 2025 levies rates, charged by the City of Calgary on new developments have increased by over 100%. The cumulative inflation rate for the same period in Alberta is somewhere between 30 and 35%. (Source: BILD Calgary Region).

Municipal levies and fees vary widely across Canadian cities due to differences in infrastructure needs, development charges, municipal policies and provincial regulations.

Calgary ranked 10th highest amongst 21 municipalities (Source: Altus

Group, Government Fees Benchmarking Study, 2022). Airdrie, Chestermere and Okotoks levies are significantly less than Calgary’s, which is one of the reasons Calgary’s edge cities are some of the fastest growing cities in Canada.

Today it is estimated, levies and development fees (application, building permits, hoarding, street closure, parking fees) increase Calgary’s housing costs by up to 15% depending on the density of the project.

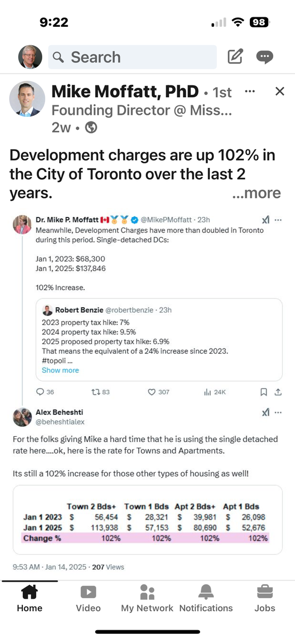

Toronto Comparison

According to the Canadian Home Builders' Association (CHBA) 2022 Municipal Benchmarking Study, the cost of government charges levied by municipal governments on new housing development in Toronto is quite high. For low-rise new infill housing development (under 6 storeys), the average cost is over $189,000 per unit. No wonder people are fleeing Toronto to find a home elsewhere.

For high-rise developments, the charges average $52 per square foot (or $52,000 for a 1,000 square foot condo).

If we assume Calgary’s levies are about 10% of the cost of a new condo, then a 1,000 square foot condo in the City Centre with a price tag of $500,000, would include $50,000 in fees, the same as Toronto’s in 2022. If it is 15%, then the number is $75,000 per condo.

No matter how you add it up, the increase in levies over the past 10+ years has contributed significantly to the rise in house price not only in Calgary, but across Canada.

Pesky Permit Fees

In addition to the levies, there are various permit fees to consider. I asked an experienced developer to ballpark me some of the permit fees for a City Centre highrise with 200 homes. He came up with $200,000 for Land Use Application studies, $40,000 for Development Permit application fee $500,000 to $750,000 for Building Permit (depending on the cost of construction) and about $100,000 in carrying costs for the 2+ years before the project is completed. This totals about $1,000,000, i.e. about $5,000/condo.

And don’t forget those hoarding, street closure and parking fees, mentioned earlier that were about $5,000 per home.

So now we are at about $60,000 per condo ($50,000 in levies, $5,000 in permit fees and $5,000 in hoarding, street closure and parking fees).

Do levy costs get passed on the buyer?

The City of Calgary’s website states, “Research from Vancouver, Ottawa, and Calgary indicates the levies do not flow directly through to homebuyers, as the market sets housing prices in a competitive market. This levies adjustment is important to ensure affordability for all Calgarians. By adjusting the rate, The City is ensuring that growth pays for its share of growth and those costs aren’t fully absorbed by taxes and utility rates. If we don’t adjust the levies and we maintain the same pace of growth, taxes will need to go up substantially to cover the costs, impacting affordability for every household and business in Calgary. What we do know, is that the levies enable the supply of new homes and businesses. More supply, at whatever price point, means fewer people are competing against each other to find a home that fits their needs and budgets. Municipalities can affect the cost of housing by enabling supply. Funding the 10 essentials (i.e. roads, sewer, water, transit, fire, emergency, library, parks, recreation, greenspace) through the levies is needed to unlock development of homes and businesses to meet the needs of Calgary’s growing population.”

Yes, the market will ultimately determine the cost of new housing, but the asking prices will reflect all the costs associated with construction of the homes, including City levies and various permit fees.

Of course builders have to pass on those fees one way or another to the buyers. And if the market will not bear a selling price that includes them, then builders will build fewer homes. And fewer homes means higher selling prices.

I stopped building spec homes several years ago because it had become far too difficult to earn even a small profit. Not coincidentally, this decision aligned with the exponential increase in existing fees and new ones added on.

Steve Blumer (Calgary home builder)

Last Word

No matter how you look at it, the upfront cost of levies and permit fees paid by Calgary’s new home builders is substantial and undeniably driving up the price of new homes and condos.

Getting back to the idea of posting home and condo prices like gas pumps prices, here is what it would look like:

45% construction costs

15% city permit/levies fees

10% land costs

5% financing and administrative costs

5% design/approval/architectural/marketing costs

5% GST on final price

15 % Profit

Total 100%

(Note: these numbers are approximations based on discussions with several developers. The actual percentages will vary from project to project).

Yes, there is a 15% profit built into the proforma, but remember the profit must be amortized over a 5+ year period given that is how long it takes to go from buying the land, to designing the building, to getting approval, to construction and finally to sale.

P.S. Don’t forget when it comes to condos with parking garages, you are looking at $30,000 for a single parking spot in a low-rise condo and $50,000 to $70,000 for a high-rise condo with a multi-storey parking garage. This can be about 10% of the home’s price.

Note: An edited version of this article was published in the Calgary Herald’s New Home + Condos section on April 5, 2025.